Pricing research for value optimisation

Pricing research, including market models, and financial forecasts, is used to help businesses identify drivers of customer value and so to set optimum price points, and build financial plans to deliver value-based pricing.

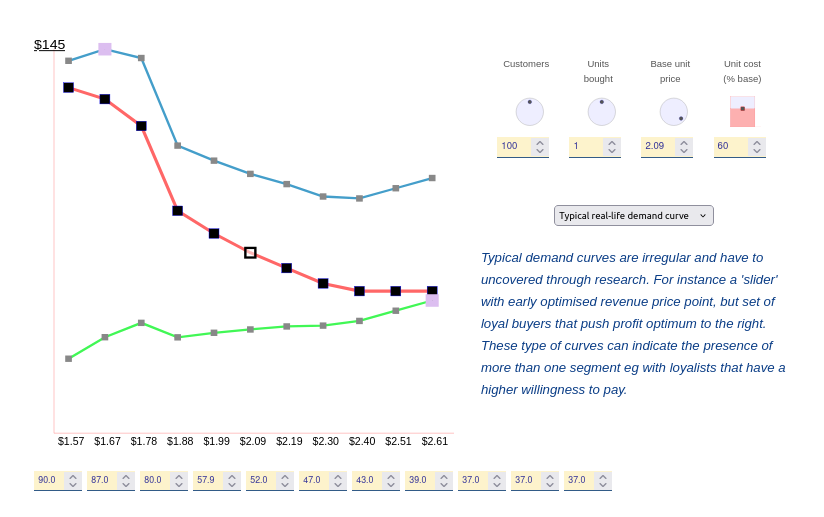

We use pricing research and financial modelling to help crystallize thinking, build forecasts and identify optimisation points to enable the business to build an appropriate product range that maximise value and profit - for example our interactive pricing explorer

Pricing and market models? Bringing data alive

Market modelling is the process of building a picture of a market for forecasting and planning purposes. Models draw upon a combination of research, intelligence and internal knowledge, starting with a qualitative description of market structure and linkages, customer segments, buying cycles, core purchase drivers and identification of purchase preferences.

When much analysis is static or fixed charts, we like to bring the data insights alive and make the analysis interactive and exploratory. For instance, our interactive pricing explorer shows how interactive models can be used to explore and understand the impact of market demand on decisions like pricing optimisation.

Willingness to pay and product value - from data to insights

A core question for pricing management, is where is there value for a customer, and what are customers willing to pay for.

By using quantitative data from research or market intelligence models of purchase behaviour can be developed in order to optimise product and marketing resources and to choose between different business options. The core tools are historial purchasing behaviour, demand forecasts, predictors for market share, and statistical models for the estimation of drivers of value and behavour.

Conjoint analysis models and choice-research techniques are common methods used to determine how product and service features affect customer demand, and so how to plan for product ranges and investment decisions.

By building demand models, the business can exploring different market scenarios, and link them to business outcomes. The level of sophistication can vary from simple statistical regressions, demand estimate, or extend into behavioural models allowing for market segmentation and different levels of competitive reactions.

Exploring markets with interactive pricing models

While models are statistical and numerical at their heart, the actual process of modelling share and prices in markets is best when the models themselves are interactive - providing tools for 'What if...?' type analysis to explore strategic and tactical options turning latent knowledge of the organisation into active perspectives about market places, customers and directions for the business.

We build fully interactive models, designed to be easy to use by product managers and senior executives. These can simply look at demand, or extend to include internal fixed and variable costs to provide insight into growth and thresholds for business planning.

For help and advice on market models and forecasting contact info@dobney.com

Discover more...

Discussion articles on creating models of markets, forecasting, running experiments and experimental marketing, and using these to develop plans and forecasts to guide investment and planning. The process of developing market strategies and pricing needs to consider the market structure, segments and decision making processes. A business market works differently to a consumer market, but there are overlaps. Understanding the value-chain and buyer's context is a vital part of understanding how pricing works.Pricing and forecasting resources

Market segments - resources